The Coronavirus is straining organizations around the country and around the world. Nobody knows if this situation will last for six weeks… or for six months. (In fact, some health authorities have suggested an 18-month social distancing practice!)

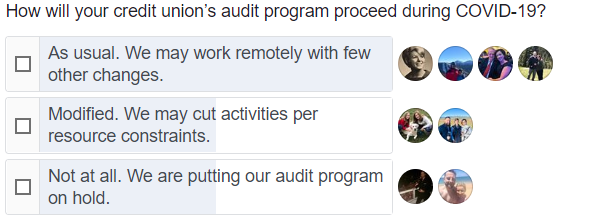

How will this crisis affect your credit union’s audit program? We asked in a short Facebook poll, and we got a few answers:

What we learned is that most credit unions intend to continue their audit program in some capacity. And, because financial institutions are considered essential businesses, they’re continuing operations as they can. (Ongoing Operations has a list of business continuity planning events to help your credit union through this.)

Here are our immediate takeaways from the poll:

- Most credit unions will continue their audit program

- Most credit unions will alter their audit program in some way

- Audit programs shouldn’t be suspended altogether unless it’s necessary

Here’s How to Run Your Audit Program Remotely

We don’t know how long this situation will last. Consequently, we think it’s best to plan for the worst. On March 26th, we’re hosting a webinar to discuss how to transition your credit union’s audit and examination programs to a remote work model.

Some topics we’ll discuss include:

- How will you need to adjust?

- If your audit team needs to work remotely, what will that mean for your credit union, your audit team, or your ability to coordinate with others?

- What processes and procedures will help your team as they work from home?

This webinar will share techniques used by other credit unions that mitigate the impact of remote work and ensure the continuity of your audit program. We’ll also share how credit unions are altering their audit programs in the face of COVID-19.

Finally, we will also offer 3 free months of Redboard’s audit software to help credit unions navigate these difficult times.

Webinar Details

Date: March 26th at 1:30 EDT

Who should attend: Credit union upper management and audit / compliance professionals

How to join: Fill out the form below

Get FREE Access to the Audit Checklist for Credit Unions!

Get FREE Access to the Audit Checklist for Credit Unions!