So, one thing I’ve learned is that when you explain a joke, it generally stops being funny. But this is about credit union audit software, what it costs, and what it provides for that cost. So please, bear with me.

Analyzing a Joke

Just like most people in the United States, I’ve been on the internet. I’ve seen the good, the bad, and fortunately, I’ve avoided most of the ugly.

One of the potential “good” things on the internet is the celebration of cats and webcomics. Cats are cute and lovable (well, not always). Webcomics afford artists the opportunity to reach audiences with their own style of art and brand of humor without mediation.

One such comic combines both things to tacitly ask a salient question about costs versus rewards. The question is: “was it worth it?”

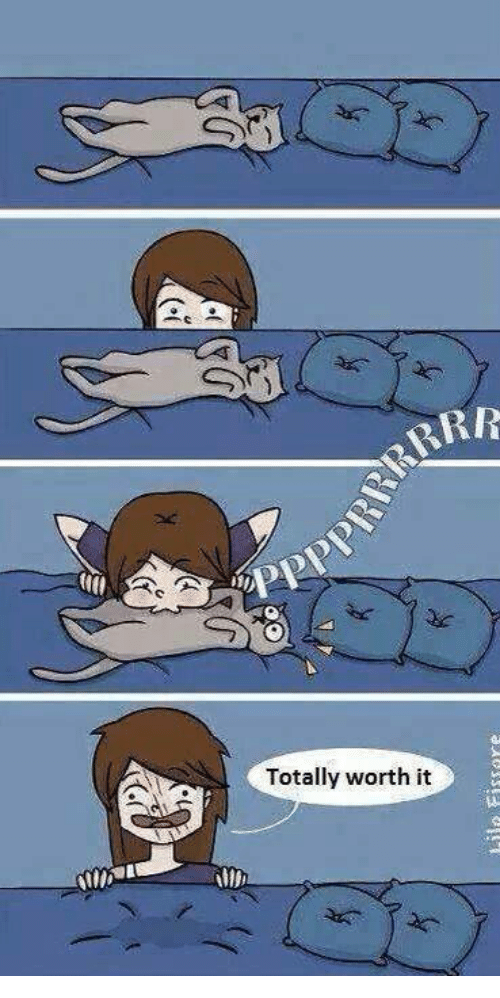

Here is the comic in question:

The joke is that cats are notoriously averse to forced affection, and they have no qualms about protecting themselves from invaders to their privacy. In the above scenario, we see the following:

- A cute, peaceful cat is enjoying a nice nap

- Our protagonist appears, clearly experiencing the following thoughts

- This cat is cute and sleeping

- It can’t be woken, or it will protect itself or otherwise ruin an opportunity for unwelcome attention

- Putting one’s face amid four startled sets of claws is a recipe for danger

- Are the consequences worth the reward?

- A decision is made, and a raspberry is blown

- The reasoning that went into the decision is revealed, as are the consequences. The scratches are “worth it” because sticking one’s face in a cat’s belly to wake it with a raspberry is silly, cute, fun, and briefly comfortable.

Now that the joke isn’t funny anymore, let’s talk about why we’re presenting it.

What is the ROI on Credit Union Audit Software?

One thing that we asked ourselves early on is: is it worth it?

We know that credit union audits are frequent, tedious, and costly. Adding a new variable to the credit union environment threatens to complicate things further.

Plus, there’s the monetary cost.

So, is it worth it?

We don’t ask only ourselves that question—we also ask potential clients. While we would love it if every single credit union could benefit from Redboard, the truth is that we’re not always a good fit.

Unfortunately, we can’t calculate ROI in exact terms. That’s because different credit unions and their audit programs are all different. Each saves a different amount of time. Each values their employees’ time differently. Each reinvests that time in different ways—some back into the audit, others into other strategic priorities.

The question then becomes less about money, and more about a judgment call. What is that reinvested time worth to your credit union?

If focusing on non-audit strategic priorities is important to your credit union’s goals, then freeing up time to work on those might be worth it. Similarly, if you want to put more time into your audits to ensure they’re correct, then freeing up time to review will also be worth it.

What We Know About ROI

The old saying, “time is money,” comes to mind.

Whether the cost of audit software is worth it might be better asked by another set of questions.

- How much time does any given audit take your team?

- How many audits does your credit have per year?

- How many hours would you save if the audit took 10% less time? How about 25% less time?

- What is that time worth?

We try to help credit unions decide whether the time they save with automation for auditing is worth it for them.

And if it’s not worth it?

Well, that’s just like blowing a raspberry on a cat’s belly when you’re not a cat person.

Evaluating Results?

Another important consideration for credit unions is whether their audit process and results are satisfactory.

Time savings and cost are far more easily quantifiable than efficacy. For example, if you think that consistency is critical to good audits, then effectiveness should be included in any ROI calculation.

So, what is the monetary value of:

- Standardized processes

- Consistent results

- Automating error-prone manual tasks

With consistency comes confidence and the knowledge that you and your team will produce high-quality deliverables.

If your credit union has had any difficulty with audits, then audit software is probably worth it.

Even for credit unions who have a sterling audit history, the extra insurance provided by a secure, automated audit program might be worth it.

FREE: Audit Checklist for Credit Unions

4 key principles and 9 questions to jumpstart your audit planning. From leading credit unions.Further Reading for Credit Unions

At Redboard, we want to provide you with all the tools you need to breeze through your audits. We want fewer headaches and consistent results.

As such, we keep our blog full of useful information for credit union audit teams. Feel free to follow the links below to see some of the other resources we’ve put together. Or, if you’re gearing up for an audit now, check out our credit union audit checklist!

Try our ROI Calculator here!

HOW THE NCUA AIRES QUESTIONNAIRES CAN HELP YOUR CREDIT UNION PREPARE FOR YOUR NEXT REGULATORY EXAMINATION

THE HIDDEN RISKS IN CREDIT UNION REGULATORY EXAMINATIONS — AND HOW TO AVOID THEM