The credit union industry is facing some of its steepest competition yet. Banks are distinguishing themselves through digital services. Fintechs are offering bold innovations. Even tech giants like Google and Apple are trying to enter the fray.

Fortunately, credit unions have a secret weapon on their side: Elon Musk.

Audits and examinations are not for the faint of heart. They require detailed, meticulous work, and they often drag on interminably. Most people who don’t work in compliance do their best to avoid them if they can. And yet, for credit unions, audits are a regular part of life.

The Coronavirus is straining organizations around the country and around the world. Nobody knows if this situation will last for six weeks… or for six months. (In fact, some health authorities have suggested an 18-month social distancing practice!)

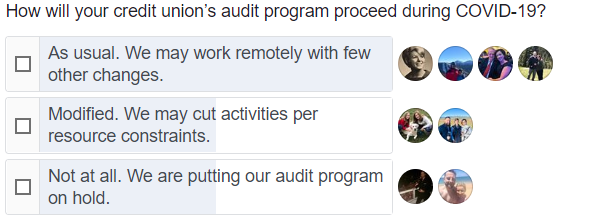

How will this crisis affect your credit union’s audit program? We asked in a short Facebook poll, and we got a few answers:

The Coronavirus is straining organizations around the country and around the world. Nobody knows if this situation will last for six weeks… or for six months.

How will this crisis affect your credit union’s audit program? How will you need to adjust? If your audit team needs to work remotely, what will that mean for your credit union, your audit team, or your ability to coordinate with others?

(This is part three in a series on the three lines of defense in credit union risk management and compliance. You can read part one here and part two here.)

Recently, we released the latest version of our credit union audit management software, Redboard 10. To meet client needs, we expanded its functionality to better incorporate internal audit teams and business users. These changes have significantly expanded Redboard’s role in audits and examinations.

Compliance and risk management are necessary at credit unions. After all, you hold the keys to your members’ livelihoods, and a mistake on your part could have major financial consequences for them.

To better manage risk, audit teams often follow the three lines of defense. These lines of defense may differ slightly for each institution, but the basics are the same. In fact, you can learn more about what each of them entails here.

We’re happy to announce the release of Redboard 10, the most comprehensive version of our audit management software platform yet. We’ve added new features and abilities that ensure smoother, more efficient credit union audits and exams.

When we debuted Redboard, it was a secure project management platform designed to help credit union compliance teams manage and navigate their annual regulatory exams. However, after incorporating client feedback, the platform is much more flexible and robust than ever.

Banking has been around for millennia, which shows just how important it is to the world. However, modern banking in our collected world brings new risks and threats. Financial institutions must operate responsibly to see that consumers thrive—and criminals don’t.

Rules and regulations keep everyone safe. But they also keep institutions busy. Credit unions in particular are familiar with the regulatory burden. Their compliance professionals and audit teams ensure smooth and stable operations.

But there are many regulations, and they have teeth. That’s why we’ve identified 10 easy credit union compliance tips to help even the most stressed-out audit teams.

Credit unions offer numerous advantages over banks and other financial institutions. Their services, fees, and rates are all top notch. And a good deal of that can be attributed to relatively strict rules and regulations regarding consumer safety.

However, they can get bogged down in those rules and regulations. The regulatory burden is heavy, and credit union compliance professionals have their hands full keeping up with changes to laws, practices, and guidelines.

Fortunately, the NCUA sends out a letter to credit unions every January. Each year, they detail their supervisory priorities for the coming year as well as any notable statutory and regulatory updates.

These are the statutory and regulatory updates for credit unions in 2020.

The world of credit union compliance is both fast-paced and high-stakes. It would be enough to drive any compliance professional mad… if there weren’t ample resources on their side.

Fortunately, the NCUA is also chock-full of compliance experts. And as such, they provide ample notice, explanation, and documentation for their regulatory moves.

Recently, the NCUA released its annual letter to credit unions. In that letter are a list of supervisory priorities for 2020. In case you haven’t seen the list yet, here’s a quick overview.

In 2019, Boeing faced the fallout of several 737 MAX airplane crashes. As the casualties rose, engineers and regulators raced to discover what was causing the flight malfunctions.

The answer was negligence of risk management across the organization. Here’s a very brief overview of what went wrong—and how following the three lines of defense would have helped.

Get FREE Access to the Audit Checklist for Credit Unions!

Get FREE Access to the Audit Checklist for Credit Unions!